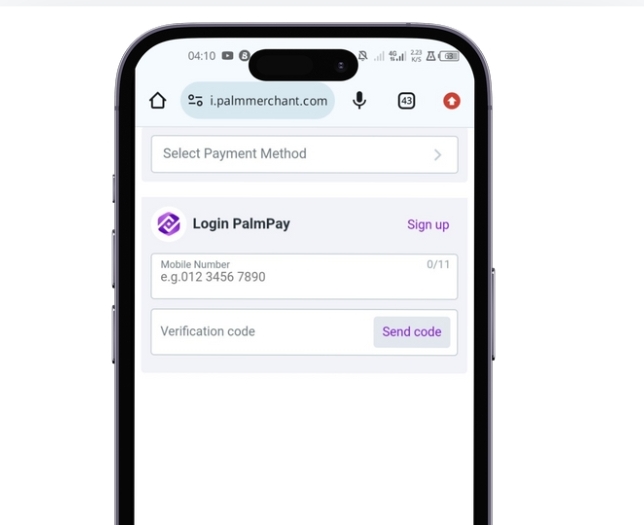

Palmpay has emerged as a prominent digital platform offering a range of financial products, including loans. However, understanding the Palmpay loan interest rate is crucial for any potential borrower. This article delves into the specifics of Palmpay’s loan interest rates, how they work, and what potential borrowers need to know before applying for a loan.

What Is The Of Meaning Palmpay?

Palmpay is a digital financial platform in Nigeria that provides a variety of services, such as mobile payments, money transfers, airtime purchases, and, most notably, quick and convenient access to loans. With the increasing demand for digital financial solutions, Palmpay has gained popularity, especially among young Nigerians and small business owners looking for quick loans without the hassle of traditional banks.

Understanding Palmpay Loan Interest Rate

One of the most critical aspects of any loan is the interest rate. The Palmpay loan interest rate determines how much a borrower will pay back in addition to the principal amount borrowed. The interest rate on a Palmpay loan is not fixed; it varies depending on several factors, including the amount borrowed, the repayment period, and the borrower’s credit history.

Learn more: How to apply for Kuda loan

Types of Loans Offered by Palmpay

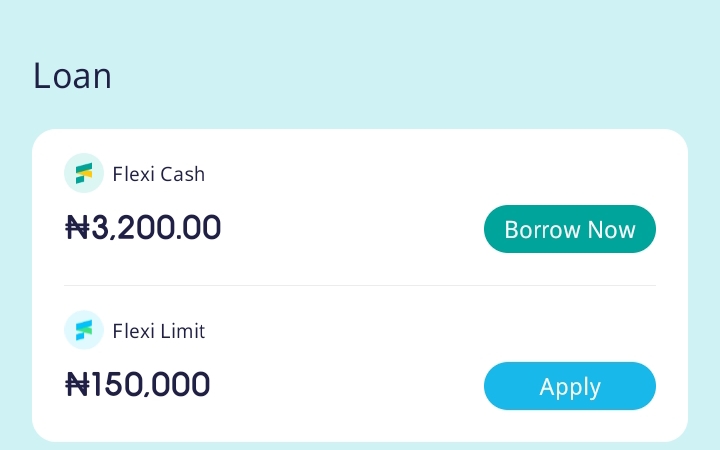

Before diving deeper into the interest rates, it is essential to understand the types of loans Palmpay offers. They provide two main types:

- Instant Loans: These are small, short-term loans that are easy to access directly from the Palmpay app. They are designed for urgent needs and typically have shorter repayment periods, often ranging from 7 to 30 days.

- Installment Loans: These are larger loans that offer more extended repayment periods, usually from three months up to a year or more. These loans are ideal for more significant financial needs, such as expanding a business or paying for a substantial expense.

Factors Influencing Palmpay Loan Interest Rate

The Palmpay loan interest rate is not static. Several factors influence the interest rate a borrower might get when applying for a loan through the Palmpay platform. These factors include:

1. Loan Amount

The amount a borrower requests plays a significant role in determining the interest rate. Generally, smaller loans might have slightly higher interest rates due to the shorter repayment periods. In contrast, larger loans could attract lower rates but come with longer repayment terms.

2. Repayment Period

The duration for which a loan is borrowed also impacts the interest rate. Shortterm loans usually have higher interest rates than that of long-term loans. This difference is because longer repayment periods spread the risk over time, which can lead to lower rates.

3. Borrower’s Creditworthiness

Palmpay, like most financial institutions, evaluates a borrower’s creditworthiness before granting a loan. The better the credit score, the lower the Palmpay loan interest rate the borrower is likely to get. A low credit score may attract higher interest rates or, in some cases, lead to loan denial.

4. Market Conditions

Economic factors and prevailing market conditions can also influence interest rates. Inflation, central bank policies, and other macroeconomic factors play a role in determining the rates lenders, including Palmpay, set for their loans.

How to Calculate Palmpay Loan Interest Rate

Calculating the Palmpay loan interest rate is straightforward, but it requires understanding the specific terms attached to the loan product chosen. The interest rate is typically expressed as a percentage of the principal loan amount. Here’s a basic formula for calculating the total repayment amount:

Total Repayment = Principal Amount + (Principal Amount x Interest Rate x Time)

Where:

- Principal Amount is the amount borrowed.

- Interest Rate is the percentage charged by Palmpay.

- Time refers to the repayment period in months or years.

Example Calculation

For instance, if you take a loan of ₦50,000 at an interest rate of 5% for a period of one month, the calculation would be:

Total Repayment = ₦50,000 + (₦50,000 x 0.05 x 1) equls to ₦50,000 + ₦2,500 = ₦52,500

So, you will need to repay ₦52,500 at the end of the month.

Palmpay Loan Interest Rate Comparison with Other Platforms

When considering a loan from Palmpay, it is essential to compare its interest rates with those of other digital lending platforms in Nigeria. Platforms like Carbon, FairMoney, and Branch offer similar services. While the Palmpay loan interest rate may be competitive, it is crucial to understand that different platforms have varying terms and conditions.

Key Differences

- Carbon: Known for slightly lower interest rates but stringent credit score requirements.

- FairMoney: Offers flexible repayment terms but may have higher rates for lower credit scores.

- Branch: Provides competitive rates and considers transaction history as a part of the credit evaluation process.

By comparing these platforms, potential borrowers can choose the most favorable terms that align with their financial situation.

Tips for Getting a Lower Palmpay Loan Interest Rate

To secure a loan with a lower Palmpay loan interest rate, consider the following tips:

1. Improve Your Credit Score

One of the most effective ways to secure a lower interest rate is by improving your credit score. Pay your bills on time, clear outstanding debts, and maintain a healthy credit history to increase your chances of getting a favorable rate.

2. Borrow Only What You Need

Borrowing only what you need reduces your overall debt burden, which can positively impact the interest rate. Smaller loans may attract higher rates due to the shorter terms, but they are easier to repay.

3. Opt for Longer Repayment Periods

Choosing a longer repayment period might lower the Palmpay loan interest rate. However, remember that while the rate might be lower, you could end up paying more in interest over time due to the extended duration.

4. Regularly Use the Palmpay App

Palmpay rewards loyal customers who regularly use their app for transactions. By using the app more frequently, you can build a better relationship with the platform, potentially leading to lower interest rates on loans.

Pros and Cons of Palmpay Loan Interest Rates

Like any financial product, there are advantages and disadvantages to consider when evaluating the Palmpay loan interest rate.

Pros

- Quick and Easy Access: Loans can be accessed directly from the Palmpay app without visiting a bank or filling out extensive paperwork.

- Flexible Repayment Options: Palmpay offers both short-term and long-term loans, catering to various financial needs.

- Transparency: Palmpay provides clear information about its interest rates and repayment terms.

Cons

- Higher Rates for Short-Term Loans: Instant loans may come with higher interest rates, making them expensive if not repaid on time.

- Penalties for Late Repayment: Failure to repay on time can lead to additional fees and higher interest rates.

Conclusion

Understanding the Palmpay loan interest rate is crucial for anyone considering taking out a loan from this digital financial platform. The rate is influenced by various factors, including the loan amount, repayment period, and the borrower’s creditworthiness. By improving your credit score, choosing the right loan product, and comparing rates with other platforms, you can secure the most favorable terms and reduce your overall borrowing cost.

Palmpay remains a viable option for quick loans in Nigeria, especially for those who prefer the convenience of digital financial solutions. However, always ensure that you are fully aware of the terms and conditions attached to any loan product to avoid unnecessary financial strain.

Final Thoughts

Before opting for a loan, it is essential to consider all the factors that could affect the Palmpay loan interest rate. By doing your research and understanding the terms, you can make an informed decision that aligns with your financial needs and goals.