Most times getting access to quick and reliable loans in Nigeria can sometimes be very challenging, especially when major commercial banks have stringent requirements. PalmPay, a popular mobile payment platform in Nigeria, has introduced an easier way to access loans directly from your smartphone. If you’re wondering how to apply for PalmPay loans, this comprehensive article will walk you through every step of the process, ensuring you understand how to navigate the app and secure a loan with ease.

What is PalmPay?

Before going into the loan application process, it’s very important to understand what PalmPay is. PalmPay is a mobile payment platform that provides a wide range of financial services, including money transfers, bill payments, airtime purchases, and most importantly, micro-loans. The platform is user friendly, designed to cater to Nigerians looking for convenient and efficient financial solutions.

Why Choose PalmPay Loans?

PalmPay loans are becoming increasingly popular for several reasons:

- Ease of Access: No need for physical visits to a bank or extensive paperwork.

- Quick Approval: Loan applications are processed swiftly, often within minutes.

- Flexible Loan Amounts: Borrowers can request small to medium-sized loans tailored to their needs.

- Secure and Reliable: PalmPay uses robust security measures to protect user information.

How to Apply for PalmPay Loans: Step-by-Step Guide

To help you understand the entire process of applying for a PalmPay loan, we will break it down into several straightforward steps:

1. Download and Install the PalmPay App

The first step in applying for a PalmPay loan is to download the PalmPay app. The app is available on both the Google Play Store for Android users and the Apple App Store for iOS users.

- Go to Your App Store: Search for “PalmPay” in the search bar.

- Download the App: Click on the “Install” button to download and install the app on your smartphone.

- Open the App: Once installed, open the app to begin the registration process.

2. Register an Account on PalmPay

After downloading the PalmPay app, you need to create an account. This is a necessary step for accessing all PalmPay services, including loans.

- Enter Your Phone Number: Provide a valid Nigerian phone number.

- Create a Secure Password: Make sure your password is strong and memorable.

- Verification: You will receive an OTP (One Time Password) via SMS. Enter this code in the app to verify your phone number.

- Complete Your Profile: Fill in your personal information, including your full name, date of birth, and residential address.

3. Link Your Bank Account

Linking your bank account to PalmPay is essential for loan disbursement and repayment.

- Go to ‘Account’ Section: Click on the ‘Account’ option on the app’s home screen.

- Select ‘Bank Account’: Choose the option to link your bank account.

- Enter Your Bank Details: Provide your bank name, account number, and other necessary information.

- Verify Your Details: Confirm your bank details to complete the linking process.

4. Check Your Eligibility for PalmPay Loans

Before applying for a loan, it is essential to check if you meet the eligibility criteria set by PalmPay. The app automatically evaluates your creditworthiness based on several factors, including your transaction history, app usage, and personal information.

- Navigate to the ‘Loan’ Section: On the home screen, click on the ‘Loan’ option.

- Check Eligibility: The app will display if you are eligible for a loan and the amount you can borrow.

5. How to Apply for PalmPay Loans

Once you have confirmed your eligibility, you can proceed to apply for a PalmPay loan.

- Click on ‘Apply for Loan’: Navigate to the loan section and click on ‘Apply for Loan.’

- Enter Loan Amount: Specify the amount you wish to borrow within your eligible limit.

- Select Repayment Period: Choose a repayment duration that suits you. PalmPay offers flexible repayment options, ranging from a few days to a few months.

- Review Loan Terms: Carefully read through the loan terms, including interest rates and repayment schedules.

- Submit Application: Once satisfied with the terms, click on ‘Submit.’

6. Approval Loan and Disbursement

PalmPay usually processes loan applications quickly. Upon submission:

- Instant Approval: If your loan is approved, you will receive a notification within minutes.

- Disbursement to Linked Bank Account: The approved loan amount will be credited to your linked bank account immediately.

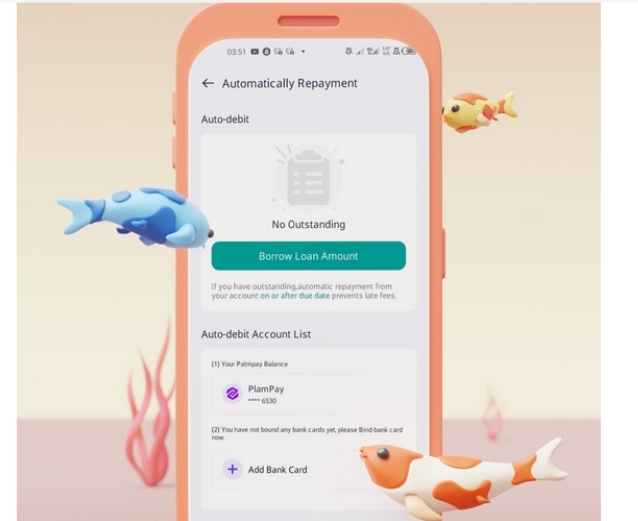

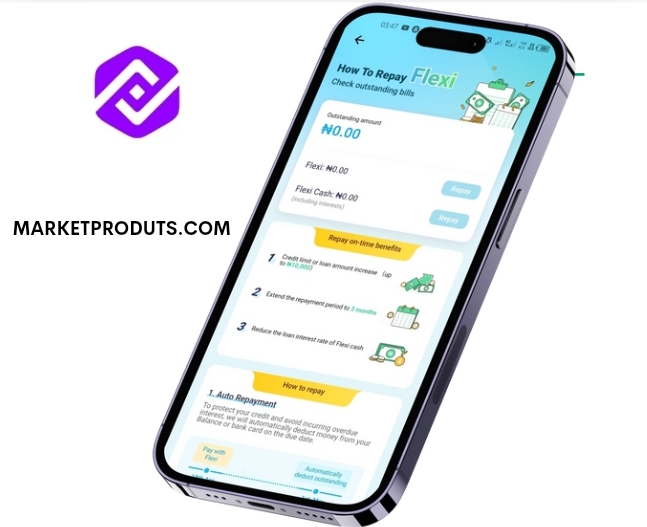

7. Repaying Your PalmPay Loan

Repaying your loan on time is crucial to maintaining a good credit score and increasing your chances of getting higher loan amounts in the future.

- Go to ‘Loan’ Section: Click on the ‘Loan’ option in the app.

- Select ‘Repay Loan’: Choose the repayment option.

- Enter Amount: Enter the amount due for repayment.

- Confirm Payment: Click on ‘Pay’ to complete the transaction.

8. Tips for Successful Loan Approval on PalmPay

To enhance your chances of getting your loan approved on PalmPay, consider the following tips:

- Maintain Regular App Usage: Engage in transactions like airtime purchase, bill payment, and money transfers using the app.

- Repay Existing Loans Promptly: A good repayment history can boost your creditworthiness.

- Keep Your Profile Updated: Ensure that your profile information is accurate and up to date.

Frequently Asked Questions (FAQs) About PalmPay Loans

What are the Requirements for PalmPay Loans?

The requirements for obtaining a loan on PalmPay include a valid Nigerian phone number, a linked bank account, and a good credit score. The app will also consider your transaction history on PalmPay.

What is the Interest Rate for PalmPay Loans?

PalmPay offers competitive interest rates, but they may vary based on the loan amount and repayment duration. Always review the loan terms carefully before applying.

How Long Does It Take to Get a Loan from PalmPay?

Loan approval and disbursement are usually instant if you meet all the eligibility criteria.

Can I Reapply for a Loan if My Application is Rejected?

Yes, you can reapply for a loan. It’s advisable to check your eligibility status and ensure you meet all criteria before reapplying.

Conclusion

Applying for a PalmPay loan is straightforward and hassle-free, providing a quick solution for Nigerians in need of financial assistance. By following the steps outlined in this guide on how to apply for PalmPay loans, you can successfully navigate the process and access funds whenever you need them. Remember to always borrow responsibly and ensure timely repayments to maintain a good credit score and eligibility for future loans.