PalmPay, as a leading financial technology app that offers quick and convenient financial services, including the ability to borrow money. For many Nigerians, borrowing from PalmPay can provide a much-needed financial cushion during tough times. This comprehensive guide will walk you through everything you need to know about how to borrow money from PalmPay, including eligibility requirements, steps to apply, repayment terms, and tips for using the service wisely.

Understanding PalmPay and Its Services

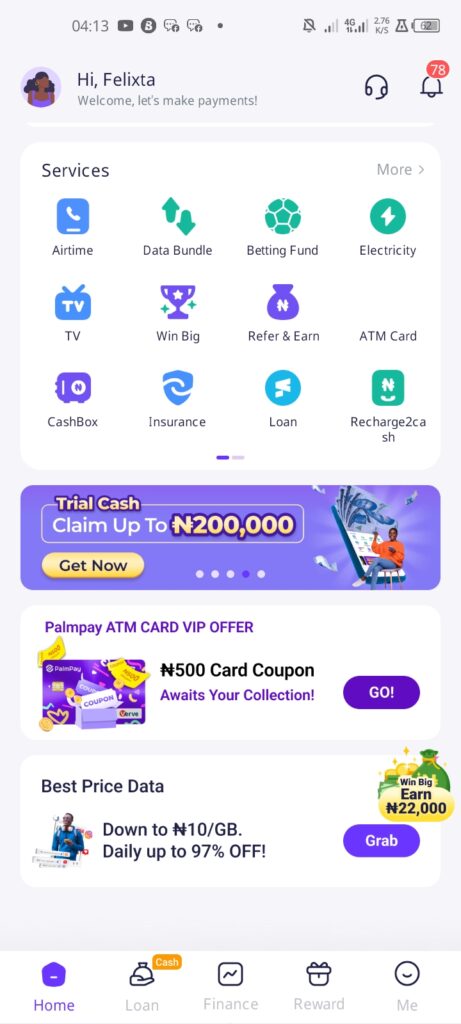

PalmPay is a mobile based financial platform that provides a variety of services, including payments, airtime purchases, bill payments, and microloans. The app aims to offer an easy, secure, and efficient way for Nigerians to manage their finances. One of its standout features is the ability to borrow money quickly and without the cumbersome paperwork associated with traditional banking.

Read more: Does Kuda offer loan?

Benefit of Borrowing Money from PalmPay

Before we go into how to borrow money from PalmPay, it’s important we understand why this platform is a good choice for quick loans:

- Instant Disbursement: Loans are disbursed instantly once approved.

- No Collateral Needed: Unlike many traditional loans, PalmPay does not require collateral.

- Low-Interest Rates: Interest rates are relatively competitive compared to other quick loan apps.

- Flexible Repayment Terms: Borrowers have flexible repayment options, making it easier to repay loans.

Eligibility Requirements for Borrowing from PalmPay

Before you can borrow money from PalmPay, you need to meet specific eligibility criteria. These requirements ensure that only credible and financially responsible individuals access the loan services. The major eligibility requirements include:

- Active PalmPay Account: You must have a registered and active PalmPay account.

- BVN Verification: Your Bank Verification Number (BVN) must be linked to your PalmPay account.

- Stable Income Source: A stable source of income is crucial to demonstrate your ability to repay the loan.

- Good Credit Score: A positive credit history improves your chances of getting a loan.

Steps on How to Borrow Money from PalmPay

Borrowing money from PalmPay is a straightforward process that involves a few simple steps. Below is a detailed guide on how to borrow money from PalmPay:

Step 1: Download the PalmPay App

To start, download the PalmPay app from the Google Play Store for Android users or the Apple App Store for iOS users. Once downloaded, install the app and register an account using your phone number and personal details.

Step 2: Complete Your Profile and Verify Your Account

After registration, you will need to complete your profile by providing necessary information, such as your full name, date of birth, residential address, and employment details. You must also verify your account by linking your BVN. This step is crucial as it helps PalmPay assess your creditworthiness.

Step 3: Navigate to the Loan Section

Once your account is verified and set up, navigate to the loan section within the PalmPay app. This section is usually found under the “Financial Services” or “Loans” tab. Here, you will see various loan options available based on your eligibility.

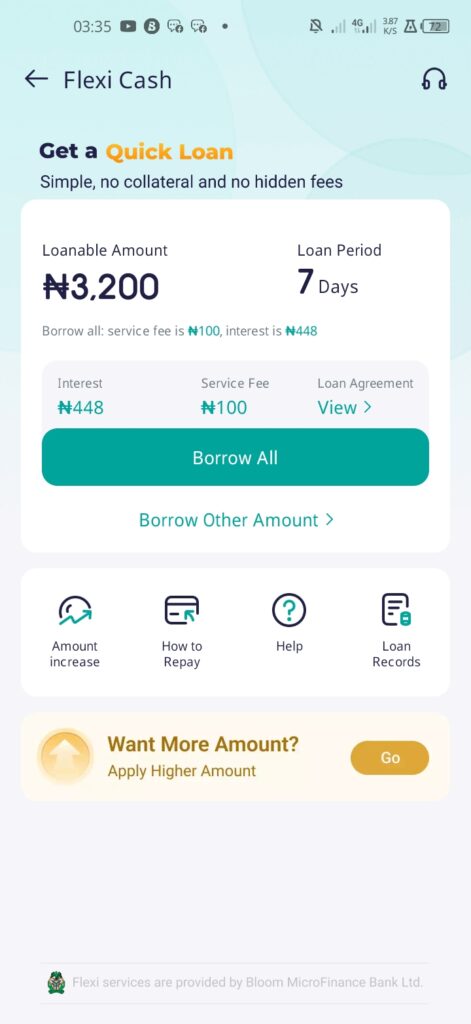

Step 4: Select the Loan Amount and Tenure

Next, select the amount you wish to borrow and the repayment period. PalmPay typically offers various loan amounts ranging from small to medium-sized loans, with repayment tenures between 7 to 180 days. Ensure that you choose an amount that aligns with your repayment capacity to avoid default.

Step 5: Review the Loan Terms and Conditions

Before applying, carefully read through the loan terms and conditions. This step is critical as it provides insight into the interest rate, processing fees, and penalties for late repayment. Ability to understand these terms helps you make an informed decision.

Step 6: Submit Your Loan Application

After reviewing the terms, click on the “Apply” button to submit your loan application. The PalmPay system will assess your application, and if you meet all requirements, your loan will be approved within minutes. You will receive a notification confirming the approval, and the loan amount will be credited to your PalmPay wallet or linked bank account.

Step 7: Repaying the Loan on Time

Once you receive the loan, ensure you repay it on time to maintain a good credit score with PalmPay. Timely repayment will increase your chances of getting a higher loan amount in future applications and avoid incurring penalties or late fees.

Repayment Options for PalmPay Loans

When it comes to repaying your PalmPay loan, there are several convenient options available:

- PalmPay Wallet: You can repay directly from your PalmPay wallet. Ensure that you have sufficient funds in your wallet to cover the repayment.

- Bank Transfer: Repayment can also be made through a bank transfer to PalmPay’s designated account.

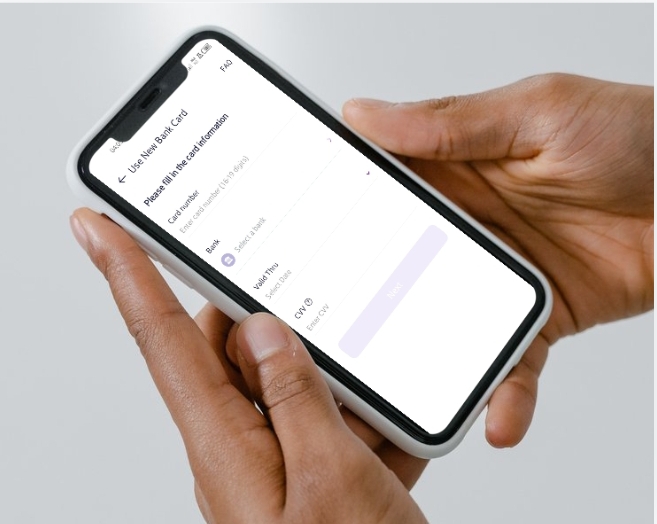

- Debit Card: You can link a debit card to your PalmPay account and use it to repay the loan automatically.

Tips for Successfully Borrowing Money from PalmPay

To maximize the benefits of borrowing money from PalmPay, here are some essential tips:

Maintaining a Good Credit History

Your credit history plays a significant role in determining your eligibility for a loan. Ensure you repay loans on time and avoid defaulting, as this can negatively impact your credit score.

Borrow What You Can Repay

It’s easy to be tempted to borrow more than you need. However, it’s essential to borrow only what you can comfortably repay to avoid falling into a cycle of debt.

Understand the Interest Rates and Fees

Always review the interest rates and associated fees before applying for a loan. Understanding these costs will help you plan your finances better and avoid unexpected charges.

Leverage PalmPay’s Promotions

PalmPay often runs promotions and offers for its users. Keep an eye out for these promotions, as they can help reduce the cost of borrowing or even provide cashback opportunities.

Common Challenges When Borrowing from PalmPay

While PalmPay offers numerous advantages, there are some challenges borrowers may face:

- Limited Loan Amounts: For new users or those with low credit scores, the loan amounts may be relatively small.

- Strict Repayment Deadlines: Failure to repay on time can lead to penalties and a negative credit score.

- App Glitches: Occasionally, the app may experience technical issues, which could delay loan disbursements or repayments.

Frequently Asked Questions About Borrowing from PalmPay

How Much Can I Borrow from PalmPay?

The amount you can borrow from PalmPay depends on several factors, including your credit score, repayment history, and account activity. New users may start with lower loan amounts, but this can increase over time with a good repayment track record.

What is the Interest Rate on PalmPay Loans?

The interest rate on PalmPay loans varies depending on the loan amount, tenure, and individual credit profile. It is advisable to review the interest rate displayed in the app before confirming your loan application.

Can I Borrow from PalmPay Without a BVN?

No, your BVN is a mandatory requirement for borrowing from PalmPay. It helps verify your identity and assess your creditworthiness.

What Happens If I Default on My PalmPay Loan?

Defaulting on your PalmPay loan can lead to several consequences, including a negative impact on your credit score, additional penalties, and being blacklisted from accessing future loans.

Conclusion

Borrowing money from PalmPay is a convenient and straightforward process that offers a quick solution for financial emergencies. With no collateral required, competitive interest rates, and flexible repayment options, it is an attractive choice for many Nigerians. However, it’s essential to borrow responsibly, understand the terms and conditions, and ensure timely repayment to maintain a good credit score and enjoy future benefits from the platform.

By following the steps outlined in this guide and utilizing the tips provided, you can make the most of PalmPay’s loan services and navigate any financial challenges with confidence.

4o

ChatGPT can make mistakes. Check important info.