Nigerian entrepreneurs constantly seek more efficient, transparent, and cost-effective ways to manage their businesses. Enter Kuda Business, a revolutionary digital banking platform designed to cater specifically to the needs of small and medium-sized enterprises (SMEs) and entrepreneurs in Nigeria. With a strong emphasis on flexibility, ease of use, and affordability, Kuda Business is rapidly becoming the go-to digital bank for Nigerian business owners. This article delves into the key features of Kuda Business, its benefits for Nigerian entrepreneurs, and how it stands out in the crowded financial sector.

Read more: 5 secrets about kuda bank.

What is Kuda Business?

Kuda Business is a digital banking solution tailored for business owners in Nigeria. Unlike traditional banks, Kuda operates entirely online, eliminating the need for physical branches and the accompanying overhead costs. This digital-only approach allows Kuda to offer a seamless, hassle-free banking experience with zero hidden charges. The Kuda Business account is specifically designed to cater to the unique financial needs of businesses, providing tools for managing finances, tracking expenses, and streamlining payments.

Features of Kuda Business

The features of Kuda Business are designed to simplify banking and offer greater control over business finances. Here are some standout features:

1. Free Business Accounts

Opening a Kuda Business account is free, and there are no monthly maintenance fees. This is a significant advantage for small businesses and startups that need to manage their overhead costs efficiently. With no account maintenance charges, businesses can allocate resources to growth and development rather than banking fees.

2. Seamless Payments and Transfers

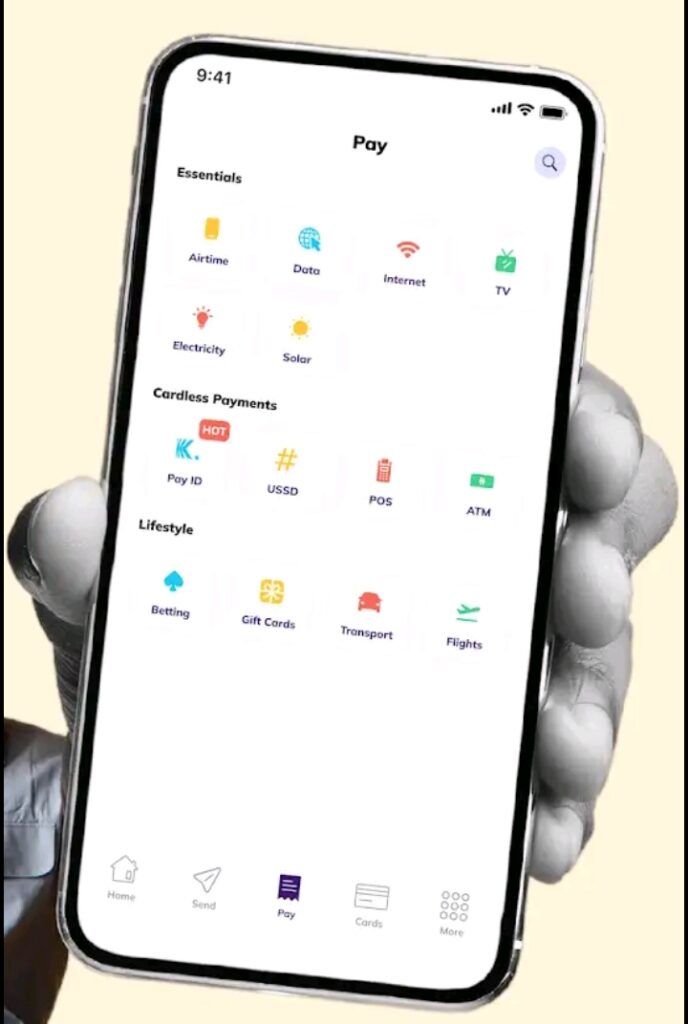

Kuda Business allows users to make quick and easy transfers to any bank in Nigeria at competitive rates. With its user-friendly app interface, business owners can manage their transactions in real-time, ensuring smooth operations and cash flow management. The app also supports bulk payments, making it easier for businesses to handle payroll and supplier payments.

3. Automated Expense Management

Keeping track of expenses can be daunting for business owners, but Kuda Business simplifies this process with its automated expense management feature. The platform provides detailed transaction records, categorizing expenses for better tracking and analysis. This helps business owners make informed financial decisions and maintain accurate accounting records.

4. Instant Access to Business Loans

Kuda Business offers eligible businesses access to quick, collateral-free loans, a feature that significantly benefits SMEs in need of working capital. The loan application process is straightforward, and funds are disbursed instantly upon approval, making it a reliable option for businesses that need immediate financial assistance.

5. User-Friendly Mobile App

The Kuda Business mobile app is designed with simplicity and usability in mind. It provides a comprehensive view of account activities, transactions, and expenses, all from a single dashboard. This ease of use allows business owners to manage their finances on the go, reducing the time spent on banking and administrative tasks.

Benefits of Kuda Business for Nigerian Entrepreneurs

The rise of Kuda Business as a preferred banking option for Nigerian entrepreneurs is no accident. The platform’s unique features offer several benefits that traditional banks often fail to provide.

1. Cost-Effective Banking Solutions

With zero account maintenance fees, free debit cards, and affordable transfer rates, Kuda Business offers a more cost-effective solution compared to traditional banks. This is particularly beneficial for small businesses that need to keep their banking costs low while still accessing essential financial services.

2. Improved Financial Management

Kuda Business’s automated expense categorization, real-time transaction alerts, and detailed financial statements help businesses manage their finances more efficiently. This level of transparency is crucial for business owners who need to monitor cash flow, reduce unnecessary expenses, and plan for growth.

3. Enhanced Accessibility

It is available 24/7, allowing business owners to access their accounts, make transactions, and manage finances from anywhere, at any time. This flexibility is invaluable for entrepreneurs who are always on the move and need quick, reliable access to their banking services.

4. Support for Business Growth

Access to quick, collateral-free loans can be a game-changer for SMEs looking to expand their operations. The ability to secure financing without the lengthy processes typical of traditional banks provides a significant competitive edge for businesses seeking growth opportunities.

5. Better Customer Support

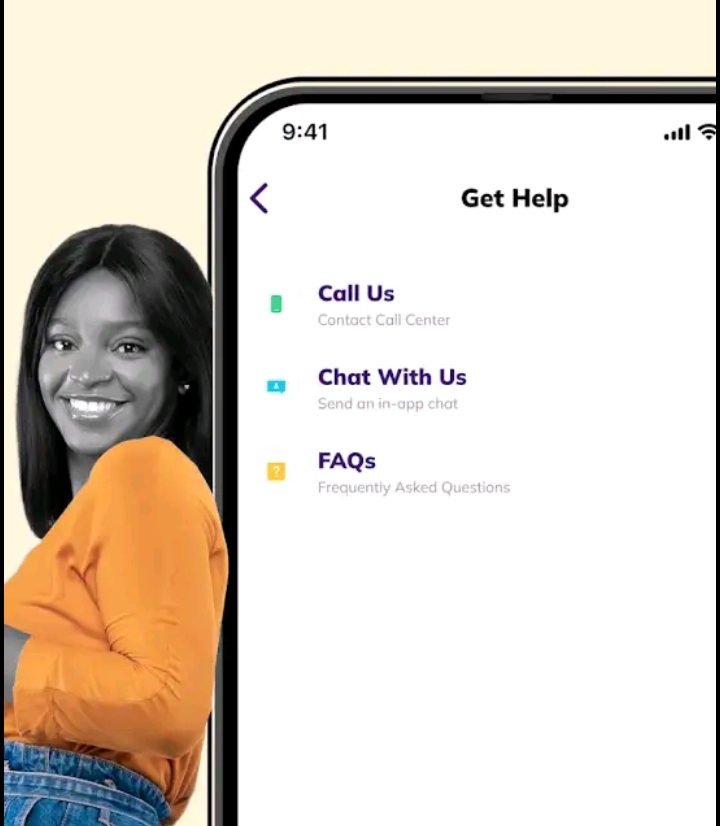

Kuda Business offers responsive customer support through various channels, including in-app chat, email, and social media. This ensures that business owners can resolve issues quickly without the usual delays associated with traditional banks.

How to Open a Kuda Business Account

Opening a Kuda Business account is straightforward and can be done in a few simple steps:

1. Download the Kuda App

The first step is to download the Kuda app from the Google Play Store or Apple App Store. The app is lightweight, user-friendly, and easy to navigate.

2. Complete the Registration Process

After downloading the app, users must provide basic information, including their business name, registration details, and contact information. The entire registration process takes only a few minutes.

3. Upload Necessary Documents

To verify the business, users must upload essential documents, such as a valid means of identification (e.g., national ID, international passport, or driver’s license), proof of business registration, and any other required documents.

4. Get Verified and Start Banking

Once the documents are uploaded and verified, the Kuda Business account is activated. Users can start making transactions, manage expenses, and access all the features offered by Kuda Business.

Kuda Business vs. Traditional Banking: A Comparative Analysis

The emergence of digital banking platforms like Kuda Business raises an important question: how does it compare to traditional banking options? Here’s a comparative analysis:

1. Lower Costs

Unlike traditional banks that charge various fees (such as maintenance fees, ATM fees, and transaction fees), Kuda Business offers a more affordable solution with zero hidden charges. This is particularly advantageous for small businesses with tight budgets.

2. Flexibility and Accessibility

Traditional banks often require business owners to visit physical branches to perform certain transactions or resolve issues. In contrast, Kuda Business provides full functionality via its mobile app, offering unparalleled convenience and accessibility.

3. Faster Services

Kuda Business offers faster services, from account opening to loan disbursement. Traditional banks may take several days or even weeks to process loans or other financial services, which can hinder business growth.

4. Enhanced Customer Experience

The customer experience with Kuda is more personalized and responsive, thanks to its digital-first approach. Traditional banks may not provide the same level of responsiveness due to their bureaucratic processes and limited customer support channels.

Challenges of Kuda Business and Areas for Improvement

While Kuda offers numerous advantages, there are some challenges that need to be addressed to further improve the user experience.

1. Limited Physical Presence

As a digital-only bank, Kuda app business lacks a physical presence, which may be a drawback for business owners who prefer face to face interactions or need physical banking services.

2. Network and Connectivity Issues

Since Kuda app business is heavily reliant on internet connectivity, users may experience disruptions in service due to poor network coverage or connectivity issues. Ensuring a more robust digital infrastructure can help mitigate this challenge.

3. Limited Loan Amounts

While kuda provides quick access to loans, the amounts may be limited compared to traditional banks, which might offer larger loans with more extensive collateral requirements. Expanding loan offerings could attract more businesses.

The Future of Kuda Business in Nigeria

The future of the Business app in Nigeria looks promising, given the increasing adoption of digital banking and the growing demand for cost-effective, flexible banking solutions. As more Nigerian entrepreneurs embrace digital platforms for their banking needs, Kuda Business is well-positioned to lead the market with continuous innovation and customer-centric services.

Conclusion

Kuda Business is redefining digital banking for Nigerian entrepreneurs by providing a cost-effective, accessible, and user-friendly platform for managing business finances. Its focus on simplicity, transparency, and efficiency has made it a preferred choice for SMEs and startups in Nigeria. While there are areas for improvement, the overall benefits of Kuda Business far outweigh its challenges. As the financial landscape continues to evolve, Kuda Business is set to play a pivotal role in empowering Nigerian businesses to achieve sustainable growth.