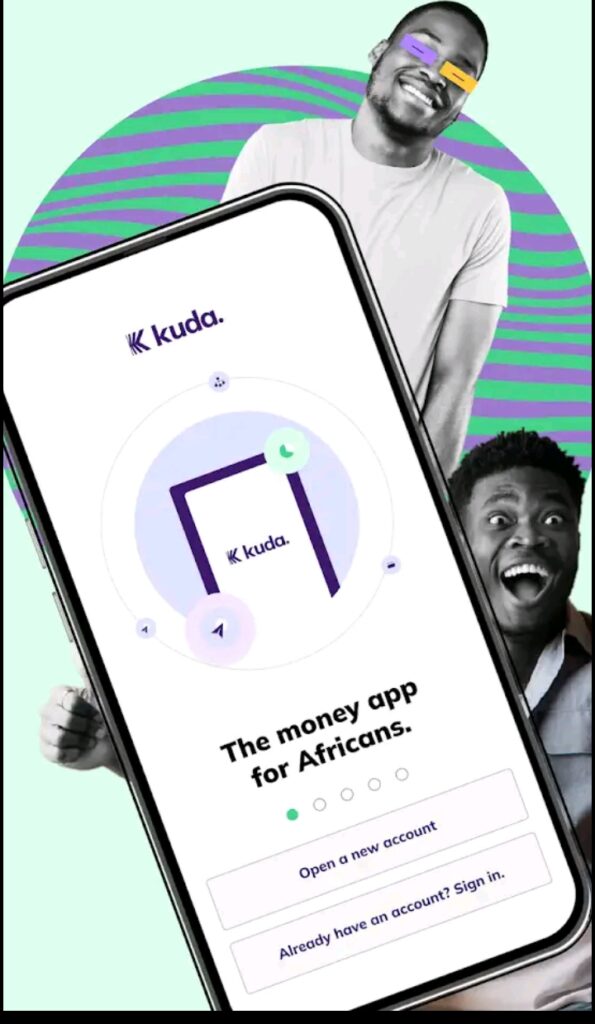

One of the most prominent players making waves in Nigeria’s financial space is Kuda Bank. Dubbed “the bank of the free,” Kuda Bank has rapidly grown to become one of the most sought-after digital banks in Nigeria, providing a seamless, user-friendly banking experience to millions of Nigerians. This article explores everything you need to know about Kuda Bank, from its features and benefits to how it compares with traditional banks in Nigeria.

Read more: How To borrow money from Polaris Bank

What is Kuda Bank?

Kuda Bank, often simply referred to as Kuda, is a fully digital bank that operates without any physical branches. Established in 2019 by Babs Ogundeyi and Musty Mustapha, Kuda Bank is licensed by the Central Bank of Nigeria (CBN) and insured by the Nigeria Deposit Insurance Corporation (NDIC). Unlike traditional banks that come with a plethora of fees and cumbersome processes, Kuda Bank is designed to offer a simplified and cost-effective banking experience.

As a digital-only bank, Kuda operates primarily through its mobile application, which is available for both Android and iOS users. The bank’s mission is to provide affordable, accessible, and user-centric financial services to all Nigerians. With Kuda, customers enjoy free transfers, no maintenance fees, and a robust set of financial tools right at their fingertips.

Features of Kuda Bank

Kuda offers a range of features that make it stand out in the Nigerian banking ecosystem. These features are tailored to meet the unique needs of its customers, providing convenience, efficiency, and transparency.

- Zero Maintenance Fees: One of the most compelling features of Kuda Bank is its zero maintenance fees. Unlike traditional banks that charge customers for maintaining their accounts, Kuda does not levy any such fees. This makes it a more affordable option for many Nigerians looking to save on banking costs.

- Free Transfers: The Bank provides a certain number of free transfers every month to other banks, making it easier and cheaper for customers to send money without incurring extra charges.

- Instant Account Opening: Opening an account with the Bank is quick and straightforward. It can be done in a matter of minutes using the mobile app, without the need for paperwork or a physical visit to a bank branch.

- Kuda Card: Kuda offers a free debit card that can be used for online transactions, ATM withdrawals, and POS transactions. The card is delivered directly to the customer’s doorstep, providing convenience and accessibility.

- Budgeting and Savings Tools: The Bank comes with in-app budgeting tools that help users manage their finances better. The app also has automated savings features, allowing customers to save a portion of their income effortlessly.

- Overdrafts and Loans: The Bank provides access to short-term loans and overdrafts with minimal interest rates. This service is particularly beneficial for customers who may need a quick loan without the lengthy processes associated with traditional banks.

How to Open a Kuda Bank Account

Opening an account is a straightforward process that can be completed in minutes. Here’s a step-by-step guide:

- Download the Kuda App: The first step is to download the Bank app from the Google Play Store or Apple App Store.

- Sign Up: Once the app is installed, users can sign up by providing their email address, phone number, and a few personal details.

- Verify Identity: To comply with the regulatory requirements of the Central Bank of Nigeria (CBN), users must verify their identity by submitting a valid ID (such as a National ID card, Driver’s License, or Voter’s Card).

- Set Up a PIN: After verification, users are required to set up a secure PIN for transactions and account access.

- Start Banking: Once the account is set up, customers can start enjoying the benefits of Kuda Bank, such as free transfers, no maintenance fees, and easy access to loans and savings tools.

Benefits of Using Kuda Bank

There are numerous benefits to using the Bank, particularly for individuals who prefer a more modern, digital approach to banking.

- Convenience: With this Bank, all banking activities can be conducted from a mobile phone, eliminating the need for physical visits to a bank branch. This is particularly advantageous for people living in remote areas with limited access to traditional banking services.

- Cost-Effective: By eliminating maintenance fees and offering free transfers, this Bank provides a cost-effective alternative to traditional banks. Customers save money on banking fees, which can be channeled into other productive ventures.

- Transparency: The Bank prides itself on being transparent with its customers. The bank provides clear and concise information about its charges, interest rates, and other terms of service, ensuring that there are no hidden fees or surprises.

- Security: The Bank takes security seriously. The app comes with several layers of security, including biometric authentication, two-factor authentication (2FA), and secure encryption protocols to protect user data and transactions.

Kuda Bank vs. Traditional Banks in Nigeria

When compared to traditional banks, Kuda Bank offers several advantages that make it a preferred choice for many Nigerians.

- Lower Costs: Traditional banks in Nigeria often charge a range of fees, including account maintenance fees, card maintenance fees, and transfer fees. Kuda Bank eliminates most of these charges, making it a more affordable option for everyday banking.

- User Experience: Kuda Bank’s mobile app is designed to provide a seamless and intuitive user experience. Unlike the cumbersome processes often associated with traditional banks, Kuda offers a straightforward, user-friendly interface that allows customers to manage their finances with ease.

- Accessibility: With Kuda Bank, there is no need to visit a physical branch. This is a significant advantage in a country like Nigeria, where many people live in rural or semi-urban areas with limited access to banking infrastructure.

- Speed of Transactions: Kuda Bank offers fast and efficient transactions, whether it’s sending money, paying bills, or applying for a loan. This speed is a marked difference from the often slow and bureaucratic processes of traditional banks.

Challenges Facing Kuda Bank

While Kuda Bank has enjoyed significant growth and popularity, it is not without its challenges. Some of these challenges include:

- Network Issues: As a digital-only bank, Kuda Bank is heavily reliant on internet connectivity. Network issues can sometimes disrupt transactions, leading to customer dissatisfaction.

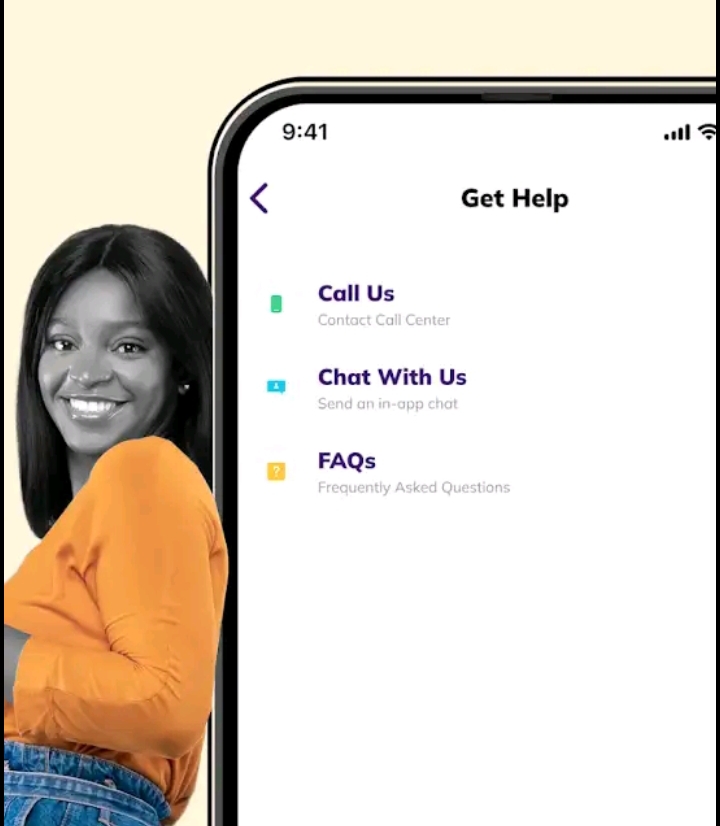

- Customer Support: There have been instances where customers have reported delays in resolving issues through Kuda Bank’s customer support channels. This is an area that the bank continues to improve.

- Limited Banking Services: While Kuda Bank offers essential banking services, it currently lacks some of the more complex financial products available at traditional banks, such as mortgage loans and certain types of investment products.

Future of Kuda Bank in Nigeria

The future looks promising for Kuda Bank as it continues to expand its customer base and enhance its service offerings. With increasing smartphone penetration and a growing demand for digital financial services in Nigeria, Kuda Bank is well-positioned to lead the charge in the country’s banking sector.

The bank has also secured significant funding from investors, which is being used to develop new features, expand its team, and enhance customer support. Kuda Bank’s focus on technology-driven solutions and financial inclusion will likely drive its growth trajectory in the coming years.

Conclusion

Kuda Bank is undoubtedly reshaping the banking landscape in Nigeria by providing a digital-first approach to financial services. With its zero maintenance fees, free transfers, instant account opening, and robust financial tools, Kuda Bank offers a compelling alternative to traditional banks. While there are challenges to navigate, the future of Kuda Bank in Nigeria looks bright as it continues to innovate and cater to the evolving needs of its customers.

For anyone looking for a more convenient, transparent, and cost-effective banking solution in Nigeria, Kuda Bank is worth considering.