Moniepoint, a rapidly growing fintech company in Nigeria, has become a trusted financial services provider, especially among small businesses and individuals. With a focus on simplifying financial transactions through its agency banking model, Moniepoint has earned a reputation for reliability and efficiency. However, many Nigerians have been asking, “Does Moniepoint give loans?” Currently, Moniepoint focuses primarily on offering seamless financial services such as funds transfer, bill payments, and cash deposits and withdrawals through its network of agents across the country. Unlike some other fintech companies that provide direct lending services, Moniepoint has not yet ventured into the personal or business loan market.

That said, the fintech landscape in Nigeria is rapidly evolving, and there is a growing demand for accessible and low-interest loans to support small businesses and individuals. As a result, there is speculation and hope among users that Moniepoint may soon add loan services to its suite of offerings. This speculation is fueled by Moniepoint’s commitment to financial inclusion and its deep understanding of the challenges faced by the average Nigerian. Thus, while the answer to “Does Moniepoint give loans?” is currently no, the company’s dynamic nature suggests that it could potentially explore this avenue in the near future.

Read more: Can kuda receive money from Abroad?

For now, those in need of loans might consider other Nigerian fintech platforms that provide instant loans with minimal documentation and competitive interest rates. Still, keeping an eye on Moniepoint’s updates is wise for those who trust and use its services frequently. With the growing popularity of its financial solutions, the company might eventually step into the loan business, offering personalized and accessible loan services to its ever-expanding user base. Until then, the question “Does Moniepoint give loans?” remains an open one, awaiting further developments from this innovative fintech player.

moniepoint loan code

Moniepoint, a rapidly growing fintech company in Nigeria, offers an easy and accessible way to secure loans through its loan code service. Designed to cater to the diverse financial needs of Nigerians, the Moniepoint loan code is a game-changer for those who require instant cash without the hassles of traditional banking processes. By simply dialing the unique loan code on your mobile phone, you can swiftly apply for a loan that suits your needs, be it for personal use, business expansion, or emergency expenses. This service is tailored to provide quick and efficient financial solutions, making it easier for Nigerians to navigate their financial journeys without unnecessary stress.

What sets Moniepoint apart is its understanding of the Nigerian market and the financial challenges faced by everyday people. With flexible repayment plans and competitive interest rates, Moniepoint ensures that getting a loan is not only easy but also affordable. The process is straightforward: after dialing the loan code, users are guided through a few simple steps to determine their eligibility and the amount they can borrow. The funds are disbursed directly to the user’s account within minutes, reflecting Moniepoint’s commitment to swift service delivery. As Nigerians continue to embrace digital solutions for their financial needs, the Moniepoint loan code emerges as a reliable and trustworthy option for accessing quick loans, empowering individuals and businesses to thrive in an ever-evolving economy.

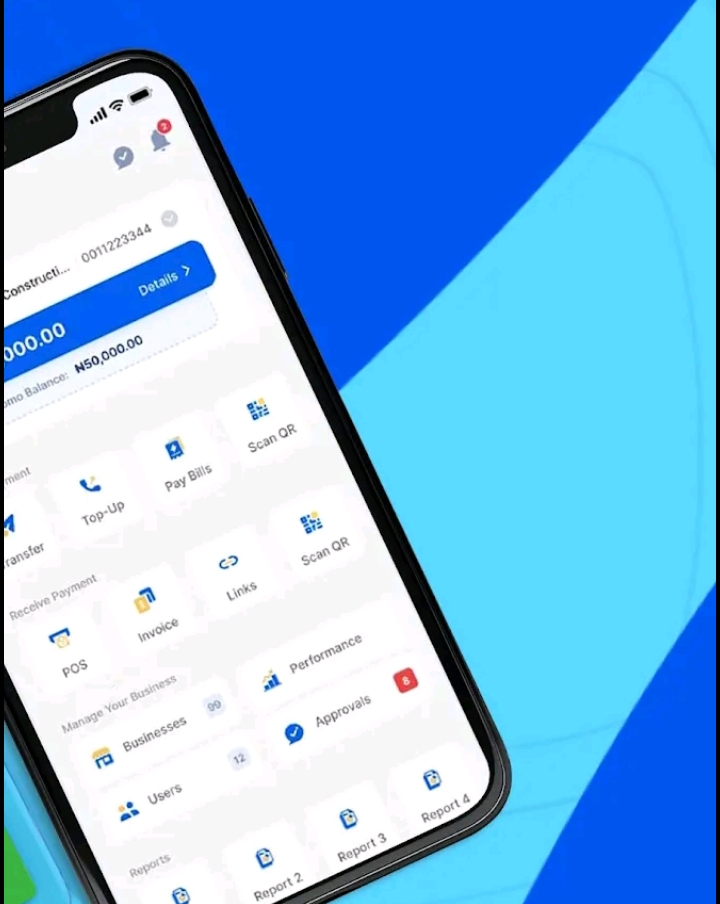

How to reset moniepoint business pin

Resetting your Moniepoint business PIN is a straightforward process that ensures the security of your business transactions. As a Moniepoint agent in Nigeria, keeping your PIN secure is crucial for safeguarding your daily transactions and protecting your business funds. To reset your PIN, you’ll first need to access the Moniepoint POS device or app. Navigate to the settings menu, where you’ll find the option for “Change PIN” or “Reset PIN.” You’ll be required to input your current PIN for verification purposes. If you’ve forgotten your current PIN, there is typically an option to verify your identity through the phone number linked to your Moniepoint account. Once verified, you can create a new secure PIN. Make sure your new PIN is unique and memorable, and avoid using simple sequences like “1234” to maintain the highest level of security.

If you encounter any issues while trying to reset your PIN, Moniepoint’s customer service is always available to assist you. You can reach them through their official support channels, such as their customer care line or by visiting their office. It’s also important to ensure that your contact information is up-to-date to facilitate smooth communication. Additionally, never share your PIN with anyone, not even customer care representatives, as they do not require it to resolve your issues. By taking these steps, you ensure that your Moniepoint business operations run smoothly without any disruptions, keeping your financial dealings safe and secure in Nigeria’s bustling business environment.

moniepoint ussd code

Moniepoint, a rising star in Nigeria’s fintech space, has made financial transactions more accessible and convenient with its USSD code service. For those who prefer banking without internet access or who live in areas with limited connectivity, the Moniepoint USSD code, *888#, is a game-changer. It allows users to perform various transactions like checking account balances, transferring money, buying airtime, and paying bills, all from the comfort of their mobile phones. With its easy-to-navigate menu, the USSD service is tailored for everyone, from tech savvy youths to market traders. One doesn’t need a smartphone or data to use this service; a basic mobile phone is sufficient. Moniepoint’s USSD code has truly bridged the gap in financial inclusion, empowering more Nigerians to manage their finances seamlessly, regardless of their location or device. As digital banking evolves, Moniepoint remains committed to delivering safe, fast, and reliable financial services that meet the needs of the everyday Nigerian.