How much is moniepoint android pos: Moniepoint has steadily become a preferred choice for Nigerian business owners looking to streamline their transactions and provide seamless payment solutions to their customers. The Moniepoint Android POS machine is renowned for its efficiency, ease of use, and support for a wide range of financial services, including cash deposits, withdrawals, and fund transfers. One of the frequently asked questions by business owners is, “How much does a Moniepoint Android POS cost?” As of 2024, the price for a Moniepoint Android POS machine ranges between ₦30,000 to ₦45,000, depending on the seller and your location in Nigeria. Some agents or distributors may offer different packages that could include additional services or benefits, potentially influencing the final cost.

However, beyond the initial purchase price, it’s important to consider the accompanying transaction fees and charges. Moniepoint is known for its competitive rates, with a commission structure that ensures agents earn on every transaction they process. Additionally, there may be fees for things like SIM card data subscriptions, device maintenance, or occasional upgrades. Before investing in a Moniepoint Android POS, it’s advisable for prospective buyers to reach out to verified Moniepoint agents or distributors, who can provide detailed information on costs, terms, and any available incentives for new users. With its reliable customer support and widespread agent network across Nigeria, Moniepoint continues to stand out as a top choice for businesses looking to simplify payments and boost their customer experience.

Read more: Does Kuda offer loan?

How to open moniepoint account

Opening a Moniepoint account is a straightforward process that brings the convenience of seamless banking right to your fingertips. Moniepoint is one of Nigeria’s leading financial services platforms, providing a wide range of banking solutions, including savings, transfers, bill payments, and more, all designed to make life easier for Nigerians. To get started, first, download the Moniepoint app from the Google Play Store or Apple App Store. Once installed, launch the app and follow the prompts to register. You’ll need to provide basic information such as your name, phone number, and email address. An OTP (One-Time Password) will be sent to your phone to verify your identity. After entering the OTP, you can set up your PIN, which serves as your security code for all transactions. With these few steps, you’re already halfway to enjoying hassle-free banking!

To complete the account opening process, you must provide additional KYC (Know Your Customer) details, such as your Bank Verification Number (BVN) and a valid government-issued ID like a National ID card, Driver’s License, or International Passport. This step ensures your account is secure and compliant with regulatory standards. After submitting these details, your account will undergo a brief verification process, which typically takes a few minutes. Once verified, you can begin using your Moniepoint account to send money, pay bills, buy airtime, and much more. With its user-friendly interface and wide range of services, Moniepoint is quickly becoming a preferred choice for many Nigerians seeking reliable and efficient financial solutions. So, why wait? Open your Moniepoint account today and experience the ease of modern banking.

login to moniepoint

Logging into Moniepoint, one of Nigeria’s most trusted platforms for seamless banking and financial transactions, is as straightforward as it gets. Whether you’re a business owner, an agent, or just someone looking to simplify their daily transactions, accessing your Moniepoint account is quick and easy. To get started, visit the official Moniepoint website or launch the mobile app on your device. On the homepage, click on the “Login” button, where you’ll be prompted to enter your registered email address and password. Ensure your details are correct to avoid any login issues. If you’ve forgotten your password, don’t worry—simply click the “Forgot Password” link and follow the instructions to reset it. For extra security, it’s wise to enable two-factor authentication, which adds an extra layer of protection to your account. With this straightforward process, Moniepoint continues to be a favorite among Nigerians, offering reliable financial solutions that make managing your money as easy as a Sunday afternoon jollof rice feast.

USSD for Moniepoint Users in Nigeria

In the bustling streets of Nigeria, where time waits for no one, Moniepoint is redefining convenience with its USSD banking service. Moniepoint’s USSD code is a game-changer, allowing customers to access banking services without needing an internet connection or smartphone. With just a few taps on your mobile device, you can check your balance, transfer money, buy airtime, and pay bills—all with the speed and simplicity designed for the everyday Nigerian. Simply dial the Moniepoint USSD code, follow the easy prompts, and experience the power of seamless banking, no matter where you are. This innovative solution is especially vital in a country where many still face challenges with internet access. Moniepoint’s USSD banking bridges this gap, bringing secure, fast, and reliable financial services to your fingertips. It’s more than just a code; it’s the heartbeat of digital finance for the hustling Nigerian, ensuring that everyone, from city dwellers to those in remote villages, can access financial services with ease and security.

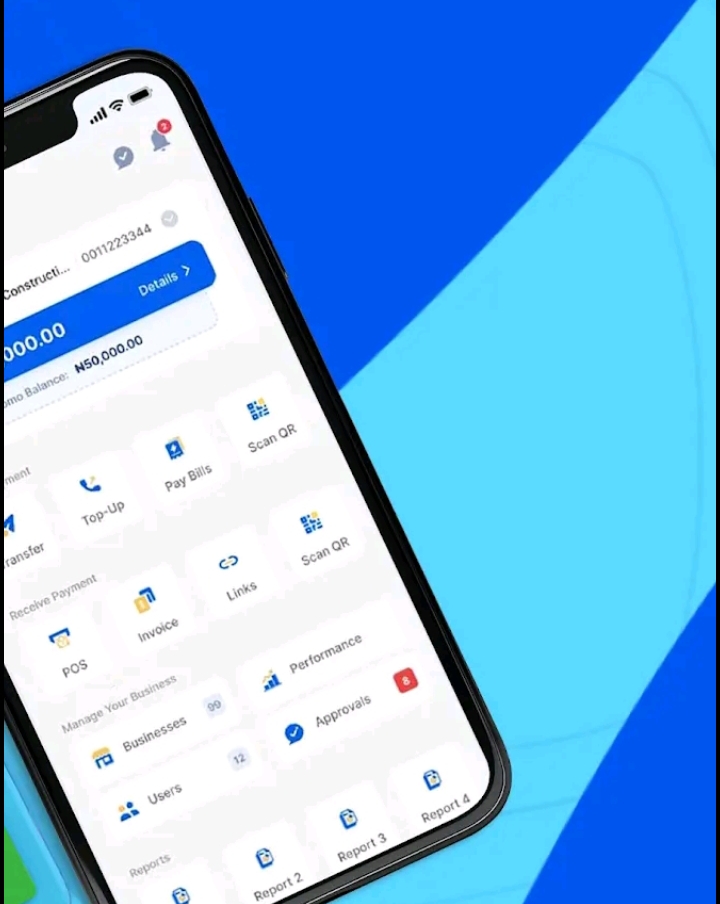

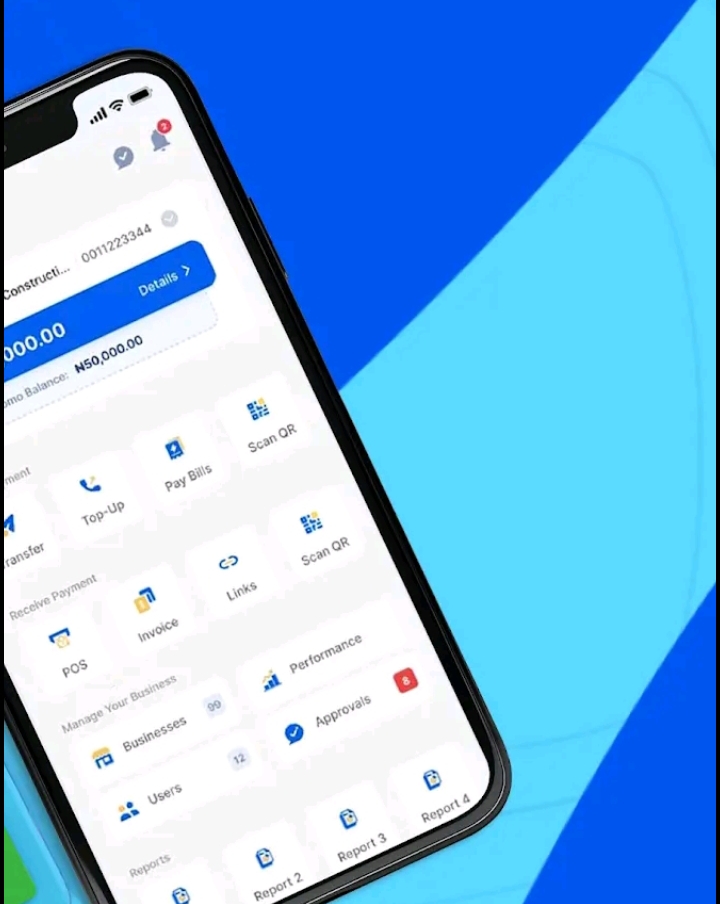

moniepoint app

Moniepoint app has become a game-changer for Nigerians looking to simplify their financial transactions and manage their businesses seamlessly. Developed with the local market in mind, this app offers more than just the basic banking services. With Moniepoint, users can perform a wide range of transactions, including sending and receiving money, paying bills, and managing airtime top-ups—all with the tap of a button. What sets Moniepoint apart is its focus on empowering small business owners, giving them tools to manage their finances, monitor sales, and access instant loans to keep their businesses thriving. The app’s user-friendly interface, secure payment channels, and swift transaction processing make it a popular choice among Nigerians who desire convenience and reliability. In a country where mobile banking is steadily becoming the norm, Moniepoint is stepping up to ensure that everyday transactions are smooth, transparent, and accessible to everyone, whether in bustling Lagos or the serene streets of Enugu.

Moniepoint Agent Login

As a Moniepoint agent, the login process is straightforward and tailored to keep your business running smoothly, ensuring you can cater to the needs of customers efficiently. To access your Moniepoint agent account, all you need to do is visit the Moniepoint official website or open the mobile app, then enter your registered phone number and password. Once logged in, agents can perform a variety of transactions, including cash withdrawals, deposits, transfers, bill payments, and more. This easy-to-use platform not only brings financial services closer to the unbanked and underbanked populations but also provides agents with a secure and reliable way to manage their daily operations without hassle.

For agents looking to maximize their business potential, Moniepoint offers a range of tools and support to help them succeed. The platform is designed with the Nigerian market in mind, making it adaptable to the unique challenges faced by agents across different states. From Lagos to Kano, Port Harcourt to Enugu, Moniepoint agents are at the forefront of providing financial inclusion to millions. With 24/7 customer support and a user-friendly interface, Moniepoint ensures that every agent can easily navigate the system, resolve any issues promptly, and focus on delivering excellent service to their community. By logging in daily, agents can stay updated with the latest features and offers, ensuring they remain competitive in the dynamic Nigerian financial landscape.

moniepoint customer care number

Moniepoint is a popular financial service provider in Nigeria, known for its reliable and secure payment solutions. Whether you’re a business owner using Moniepoint’s POS services or a customer making seamless transactions, you may occasionally need assistance to resolve issues or inquiries. For swift and efficient customer support, Moniepoint has made it easy for customers to reach out to their support team. If you encounter an error message stating “Verification failed” or face any other challenges while using Moniepoint services, the best course of action is to contact their customer care team for a thorough explanation and solution. You can get in touch with them by calling the Moniepoint customer care number at +234 201 888 9990.

When you call Moniepoint’s customer care number, their dedicated representatives are ready to assist you with any issues you may be facing, from transaction disputes to troubleshooting errors with their POS machines. In addition to calling, you can also email them at support@moniepoint.com for detailed support or inquiries. Moniepoint’s customer care team is well-trained to provide clear and concise solutions tailored to your needs, ensuring that your experience with their services remains smooth and satisfactory. Rest assured, reaching out to them via their official contact channels guarantees you the best assistance and resolutions to any issues you might encounter.

moniepoint business account

Moniepoint Business Account emerges as a game-changer for entrepreneurs and SMEs. Designed with a distinct Nigerian flair, this account offers a seamless blend of convenience and efficiency tailored for the dynamic business environment. Moniepoint delivers a robust suite of features, from easy money transfers and payments to comprehensive transaction tracking and account management. Its user-friendly interface and responsive customer service cater specifically to Nigerian business needs, ensuring that every transaction, no matter how complex, is handled with ease. Embracing Moniepoint means stepping into a future where financial operations are not just streamlined but also enriched with the local understanding and support every Nigerian business deserves.