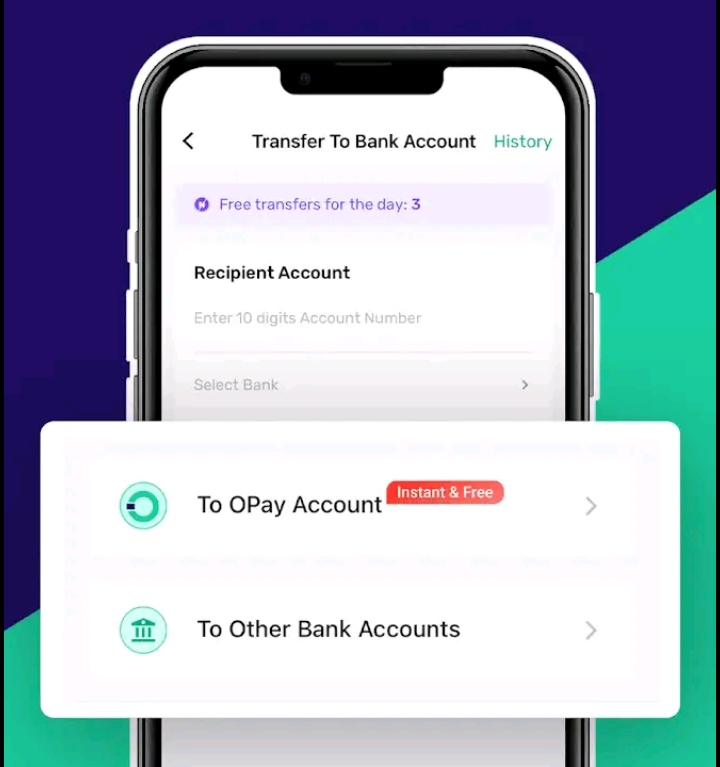

Can i borrow money from opay?. Borrowing money from OPay is a convenient option for Nigerians looking for quick and easy access to funds. OPay, a popular mobile payment and financial services platform in Nigeria, offers a lending feature known as “OKash.” To get started, download the OPay app from the Google Play Store or Apple App Store and register an account. Once registered, navigate to the “Finance” section within the app and select “OKash.” Follow the on screen instructions to apply for a loan. The process is straightforward and typically requires you to provide some personal details, link your BVN (Bank Verification Number), and agree to the loan terms. If approved, the funds are instantly disbursed to your OPay wallet, making it a hassle-free option for emergencies or short term financial needs.

Read more: 5 Business loans in Nigeria

OPay loans are designed to be accessible, with varying loan amounts and flexible repayment options to suit different financial situations. The loan amount you qualify for depends on factors such as your creditworthiness, transaction history on the app, and repayment behavior. New users might start with smaller loan amounts, but as they build a reliable repayment record, their loan limits can increase. The repayment period typically ranges from 7 to 30 days, and you can easily repay the loan through the app by transferring funds from your OPay wallet or linked bank account. Keep in mind that OPay charges an interest rate on the loan, so it’s important to review the terms carefully before borrowing. By leveraging the convenience and flexibility offered by OPay, Nigerians can access quick loans without the lengthy procedures often associated with traditional banks.

However, it’s important to understand the terms and conditions associated with borrowing from OPay to avoid any future misunderstandings. The interest rates, repayment period, and any potential fees should be carefully reviewed before confirming the loan. OPay typically offers short-term loans, and repayment can be made directly through the app, ensuring a seamless and efficient process. Additionally, timely repayment of loans can help improve your credit score on the platform, making you eligible for higher amounts in the future. For Nigerians seeking quick, reliable, and stress free access to credit, OPay provides a viable option that aligns well with modern financial needs.

Does OPay Give Loans?

Yes, Opay does provide loan services through its subsidiary, OKash. OKash is a micro-lending service available on the Opay appthat allows users to access quick, collateral-free loans tailored to meet urgent financial needs. With just a few taps on the Opay app, Nigerian users can apply for a loan, undergo a brief assessment, and receive funds directly into their Opay wallet or linked bank account within minutes. The application process is simple and hassle-free, requiring basic personal information and a good credit history. The interest rates are competitive, and repayment terms are flexible, making it a convenient option for many Nigerians looking for short-term financial solutions. However, as with any financial service, it’s important for users to carefully read the terms and conditions, understand the interest rates, and have a clear repayment plan to avoid unnecessary debt traps.

Read more: How much is moniepoint android POS

Opay loan application

The Opay Loan application offers a seamless process for obtaining microloans without the cumbersome paperwork associated with traditional banks. With just a few taps on your smartphone, you can access the loan service directly from the Opay app, provided you meet certain eligibility criteria like having a consistent transaction history on the platform. Designed to cater to Nigerians’ everyday needs, whether for small business expansion, urgent bills, or personal use, the Opay Loan is flexible, with competitive interest rates and repayment options that suit different financial capacities. This accessibility and convenience have made Opay Loans a popular choice for individuals looking for financial support, making it a go to solution in Nigeria’s ever evolving fintech landscape.

Can i Borrow money from opay without bvn

Yes, you can borrow money from Opay without a BVN (Bank Verification Number), but there are a few things to consider before diving in. Opay, a popular mobile payment platform in Nigeria, offers quick loans through its “OKash” service to users who may not have a BVN. However, this comes with certain limitations. Without a BVN, the loan amounts you can access might be lower, and you may face higher interest rates because the platform sees you as a higher-risk borrower. To apply, you simply need to download the Opay app, register with your phone number, and fill in the necessary details. Once approved, you can receive the loan directly into your Opay wallet within minutes. Remember, while the convenience is attractive, it’s crucial to understand the terms and ensure you can repay on time to avoid falling into a debt trap. While borrowing without a BVN provides flexibility, getting your BVN linked can open up more financial opportunities with better terms and higher loan limits.

How to Borrow Money from OPay on iPhone

Borrowing money from OPay on your iPhone is as straightforward as ordering a plate of jollof rice from your favorite buka. If you’re in need of quick cash for an emergency or to sort out pressing needs, OPay’s loan service, known as OKash, is here to help. First things first, you need to have the OPay app installed on your iPhone. If you haven’t downloaded it yet, head over to the Apple App Store and search for “OPay.” Once installed, open the app and log in or register if you haven’t done so. Navigate to the “Loan” or “Finance” section in the app, where you’ll find OKash. Click on it, and you’ll see an option to “Apply Now.” Fill in the necessary details, such as your BVN, income information, and loan amount desired. Once you submit, the system will quickly assess your eligibility. If approved, the money will be credited to your OPay wallet within minutes. Remember, to improve your chances of approval, keep a good transaction history and maintain an active OPay account. Whether you’re using the funds to fuel your hustle or cover an unexpected bill, OPay has made borrowing money on an iPhone as easy as a few taps.

Read more: Does moniepoint gives loan?

How much can I borrow from Okash for the first time

When it comes to securing a quick and reliable loan in Nigeria, Okash has become a popular choice for many, especially for first time borrowers. If you’re new to the platform, you might be wondering how much you can borrow from Okash for the first time. Typically, Okash allows first-time users to borrow between ₦3,000 to ₦50,000, depending on several factors, including the information you provide during the registration process and the app’s assessment of your creditworthiness. The loan amount you qualify for may start on the lower side, but as you build trust by repaying on time, Okash gradually increases your borrowing limit. The beauty of Okash lies in its flexibility and convenience—offering quick access to funds without the hassle of lengthy paperwork. For Nigerians looking for a simple and straightforward loan solution, Okash offers an easy entry point, with a promise of higher borrowing limits as you establish a positive borrowing history.